Euro Investing into Mistral AI: Europe’s Bold Leap into Artificial Intelligence

A landmark euro investment transformed the European artificial intelligence (AI) ecosystem with a strategic funding round led by ASML, Europe’s semiconductor giant, into Mistral AI, an emergent French AI startup. ASML’s injection of approximately €1.3 billion into Mistral’s €1.7 billion Series C round established the Dutch company as the largest shareholder with an 11% stake and valued Mistral at about €11.7 billion. This pivotal collaboration symbolizes Europe’s ambition for technological sovereignty, competing against U.S. and Chinese tech dominance, and signals accelerated AI innovation supported by integrated semiconductor and AI expertise.

Background on Mistral AI

Mistral AI was founded in 2023 in Paris by ex-Google DeepMind and Meta researchers with a vision to build a European alternative to the AI models dominating the global market. Despite its relative youth, Mistral has quickly risen as Europe’s premier AI startup, focusing on developing large language models (LLMs) and AI technologies that promise custom decentralized solutions for complex industrial and engineering challenges. Their portfolio includes products like the Le Chat chatbot, designed for advanced reasoning, coding, and mathematical capabilities, showcasing tech rivals to OpenAI’s ChatGPT and Chinese competitors DeepSeek and Alibaba.

The Strategic Role of ASML Investment

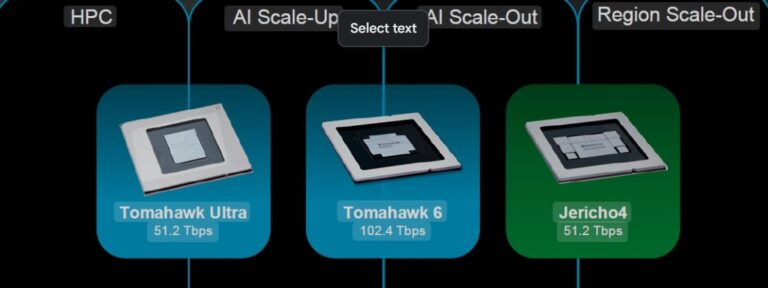

ASML Holding NV, headquartered in the Netherlands, is a global leader in semiconductor manufacturing equipment, producing the cutting-edge machinery needed to fabricate the most advanced microchips powering AI computation worldwide. Their €1.3 billion investment in Mistral is a strategic partnership beyond pure finance. It unites two European tech leaders with complementary roles in the AI value chain—semiconductor hardware and AI software models. This synergy is designed to integrate advanced AI into next-generation lithography systems, improving semiconductor production efficiency, innovation speed, and strengthening Europe’s chip and AI industries.

European Tech Sovereignty and Competition

Europe’s tech sector has faced increasing pressure to reduce reliance on dominant American tech firms like OpenAI, Google (Alphabet), Meta, and Chinese titans. The ASML-Mistral alliance is a direct response to geopolitical tensions, export restrictions on high-tech manufacturing equipment, and the urgent political desire for European technological independence. ASML’s backing of Mistral helps maintain a European front in AI development, crucial to competing globally and avoiding technological stagnation. This partnership also aligns with broader European Union and French government strategies emphasizing sovereignty and innovation in digital technologies.

Funding Round and Investor Base

Alongside ASML, the Series C round brought in contributions from major venture capital firms including DST Global, Andreessen Horowitz, Bpifrance (France’s public investment bank), General Catalyst, Index Ventures, Lightspeed, and chipmaker Nvidia. This diverse investor mix not only boosts Mistral’s capital but also provides a blend of financial, governmental, and technological support, underscoring confidence in Mistral’s vision. The €1.7 billion funding will accelerate research, expand compute infrastructure, and foster development of customized AI models for strategic industry applications.

Technological Ambitions and Market Prospects

Mistral aims to advance frontier AI research by delivering scalable, high-performance models tailored to solve sophisticated engineering and industrial problems. Coupled with ASML’s engineering leadership, the partnership will co-develop AI-enhanced semiconductor manufacturing tools, pushing the boundaries of chip design and production automation. This technological collaboration offers a potential competitive edge in markets where AI-driven hardware-software convergence can lower costs and improve performance, both critical in a fiercely contested global AI arena dominated by U.S. and Chinese firms.

Challenges and Global Context

Despite its meteoric rise and impressive valuation, Mistral faces significant hurdles. It competes in a crowded market where OpenAI’s valuation has reached $500 billion and other AI giants from China invest heavily. Mistral’s comparatively smaller size demands agile innovation, strong strategic partnerships like with ASML, and continuous capital to narrow the competitive gap. Moreover, geopolitical factors such as export controls and supply chain complexities further complicate the race for AI supremacy in which Mistral plays a critical role as a European contender.

Economic and Industrial Impacts on Europe

The investment exemplifies how AI can transform Europe’s industrial landscape beyond digital services. By harnessing AI to optimize semiconductor manufacturing, industries from healthcare and agriculture to mobility and energy could reap efficiency gains. ASML’s involvement ensures that Europe remains at the technological forefront of producing chips essential for AI workloads, whereas Mistral’s models empower diverse applications across sectors. Such synergy can stimulate entrepreneurship, create high-tech jobs, and reduce Europe’s dependency on imports of AI-related technologies.

Conclusion

The €1.3 billion euro investment from ASML into Mistral AI represents a foundational shift in European AI development and technological independence. By bridging AI software innovation with semiconductor manufacturing excellence, the partnership aims to position Europe as a formidable AI contender on the world stage. This landmark funding round, valuation milestone, and strategic collaboration underscore the continent’s resolve to foster homegrown AI leadership amid global competition. If successful, the alliance could reshape the AI and tech landscape in Europe, promoting innovation, resilience, and economic competitiveness.

Euro Union investing in Mistral AI through ASML’s landmark funding emphasizes a new era of collaboration between AI and semiconductor sectors, reinforcing Europe’s commitment to advanced technology sovereignty and global AI competitiveness. It remains a compelling case of strategic investment shaping the future of artificial intelligence both regionally and globally.

Enjoyed this post?

Subscribe to Evervolve weekly for curated startup signals.

Join Now →