AI Stocks in 2025: Strategic Bets, Capital Risks, and the Rise of Infrastructure Plays

The AI stock landscape in 2025 is no longer defined by speculative hype—it’s shaped by capital intensity, infrastructure scale, and strategic partnerships. From Nvidia’s $100B commitment to OpenAI to Oracle’s $455B in future obligations, the market is undergoing a transformation: AI is no longer a feature—it’s a balance sheet item.

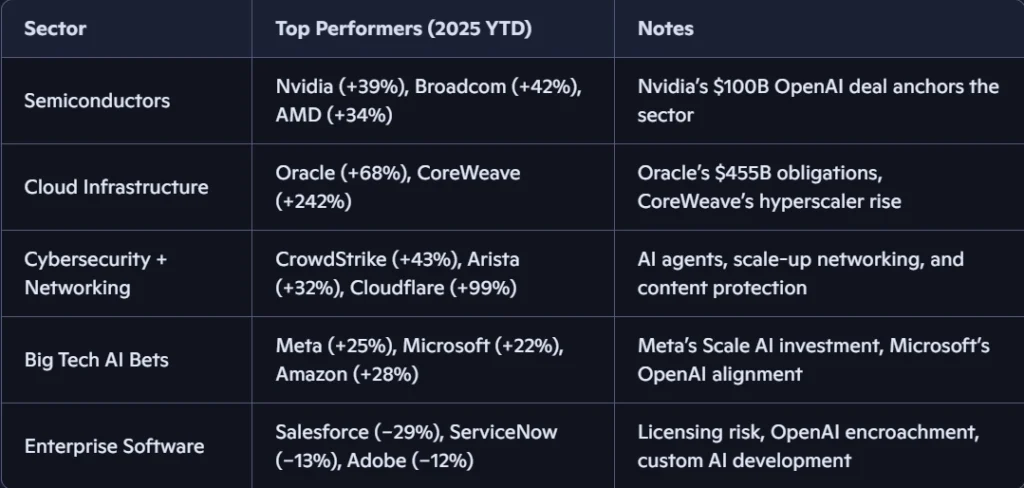

We highlight the top-performing AI stocks, emerging infrastructure players, and the risks facing software incumbents. This article expands on those insights, analyzing sector trends, capital flows, and competitive dynamics across semiconductors, cloud infrastructure, cybersecurity, and enterprise software.

Semiconductor Giants: Nvidia, AMD, Broadcom

Nvidia (NVDA) remains the bellwether of AI hardware. After a 39% rebound in 2025, Nvidia announced a $100B investment in OpenAI, structured as a staged deployment tied to gigawatt-scale data centers. The first $10B will be released upon completion of the initial gigawatt, expected in late 2026.

Key points:

- Nvidia’s Vera Rubin platform will anchor future deployments.

- OpenAI will make direct cash purchases of Nvidia systems.

- Nvidia will take an equity stake in OpenAI, deepening its strategic alignment.

Broadcom (AVGO) has surged 42% this year, buoyed by strong AI chip sales and a rumored deal with OpenAI. Its Q2 earnings beat expectations, and analysts expect continued growth in hyperscale networking.

AMD (AMD), despite underwhelming earnings, is up 34% in 2025. Its MI300X chips are gaining traction in enterprise inference workloads, but it trails Nvidia in training performance and ecosystem integration.

Cloud Infrastructure: Oracle, CoreWeave, Meta’s AI Cloud Bet

Oracle (ORCL) is the surprise breakout. Its stock is up 68% in 2025, driven by:

- $455B in remaining performance obligations, tripling from the previous quarter.

- Projected $144B in cloud infrastructure revenue over five years.

- Planned $35B in capital spending for fiscal 2026.

Oracle’s Analyst Day on October 16 is expected to reveal more about its AI World strategy, including financing models for data center build-outs and return on invested capital (ROIC) metrics.

CoreWeave (CRWV) has advanced 242% this year, peaking at 367% before its IPO lock-up expiration. It rents out Nvidia GPU-equipped servers to OpenAI, Microsoft, and Meta. Meta recently signed a deal to expand its AI cloud capacity with CoreWeave.

Other infrastructure players include:

- Nebius (NBIS): AI compute provider for Microsoft.

- Lambda Labs: Preparing for IPO.

- Crusoe, Nscale: Emerging GPU cloud platforms.

Cybersecurity and Networking: CrowdStrike, Arista, Cloudflare

CrowdStrike (CRWD) is up 43% in 2025, positioning itself as a leader in AI-driven cybersecurity agents. Its Falcon platform uses generative AI to automate threat detection and response.

Arista Networks (ANET) has gained 32%, driven by demand for scale-up networking—high-speed interconnects between GPUs in hyperscale data centers. CEO Jayshree Ullal emphasized Arista’s role in enabling AI workloads during the company’s September Analyst Day.

Cloudflare (NET) has surged 99%. It recently introduced tools to block AI crawlers, protecting proprietary content from unauthorized model training. CEO Matthew Prince has positioned Cloudflare as a defender of digital sovereignty in the AI era.

Software Struggles: Salesforce, ServiceNow, Adobe

While infrastructure and hardware stocks soar, enterprise software companies are lagging. Key concerns include:

- Per-seat licensing risk: If AI boosts productivity but reduces headcount, software vendors may lose license revenue.

- Custom AI development: Companies are increasingly building in-house tools using generative coding platforms.

- OpenAI encroachment: OpenAI’s new agents target go-to-market workflows, threatening CRM incumbents.

Performance snapshot:

- Salesforce (CRM): Down 29% in 2025. Acquired Informatica for $8B to bolster data integration.

- ServiceNow (NOW): Down 13%.

- Adobe (ADBE), Workday (WDAY), HubSpot (HUBS): All in the red.

Data Management Winners: Palantir, Snowflake, Databricks

Palantir (PLTR) is up 141% in 2025, though it has retreated from its August high. Its Foundry platform is gaining traction in government and enterprise AI deployments.

Snowflake (SNOW) rose 46% after strong Q2 earnings. It continues to expand its AI-native data cloud offerings.

Databricks (private) remains a key rival, focusing on unified data infrastructure for model training and deployment. Its rivalry with Snowflake and Palantir is intensifying as enterprises prioritize proprietary data control.

Big Tech Bets: Meta, Microsoft, Amazon, Apple

Meta (META) is up 25% in 2025. Its AI strategy includes:

- $14.9B investment in Scale AI for data labeling.

- Launch of the Meta AI app, powered by Llama 4.

- A new research lab focused on superintelligence, led by Alexandr Wang.

Meta’s five AI pillars: advertising, social media, business messaging, AI apps, and spatial computing.

Microsoft (MSFT) is up 22%, driven by Azure demand and its deep partnership with OpenAI. Its Office 365 Copilot is gaining enterprise traction.

Amazon (AMZN) is up 28%. It backs Anthropic and Hugging Face, and its Alexa assistant has been upgraded with generative capabilities.

Apple (AAPL) is up just 2%. It’s reportedly developing a new AI-powered Siri search feature using Google’s Gemini model. However, its fall product launch lacked major AI announcements.

Capital Spending and Depreciation Risk

AI infrastructure is expensive—and accounting matters. Oracle, Google, and CoreWeave face growing depreciation costs on data center assets. Investors are watching:

- ROIC metrics for cloud providers

- Capital spending forecasts through 2026

- Shift from training to inference workloads

Morgan Stanley notes that scale-up networking—interconnecting GPUs into supercomputers—is a key trend. Arista, Ciena, and Lumentum are well-positioned to benefit.

Competitive Dynamics: OpenAI vs. Software Giants

OpenAI’s move into the application layer—with agents for sales, contracts, and support—threatens traditional software vendors. RBC Capital calls this “a major foray up the stack.”

Anthropic, valued at $61.5B, is also expanding. Amazon is its largest investor. The commoditization of foundation models may shift value to applications and inference.

Strategic Positioning Over Hype

In 2025, AI stocks are no longer speculative bets—they’re strategic plays. Infrastructure providers like Oracle and CoreWeave are redefining cloud economics. Nvidia and Broadcom dominate hardware. Cybersecurity and networking firms are quietly building the backbone of AI deployment.

Software companies face existential questions about licensing, differentiation, and platform risk. Big Tech is hedging across models, apps, and infrastructure.

For investors, the “AI correction” isn’t a crash—it’s a realignment. Capital flows are consolidating around scale, utility, and defensibility. The winners will be those who build, not just brand or go bust.

Read more in our AI News section

Enjoyed this post?

Subscribe to Evervolve weekly for curated startup signals.

Join Now →